THE FOUNDATION

OF THE

ROMAN CATHOLIC DIOCESE OF OGDENSBURG, NY, INC.

photo taken by Jesse Sovie

The Mission of The Foundation of the Roman Catholic Diocese of Ogdensburg, New York, Inc. is to pass our living faith to future generations by financially supporting the charitable, spiritual, educational and temporal works of the Catholic Community of the Diocese of Ogdensburg by accepting donations or endowment funds from donors and the administration of these funds.

In fulfilling its mission, The Foundation will:

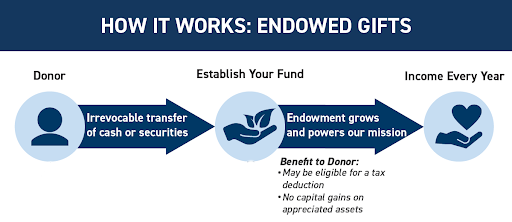

An Endowment Fund is the best way for you to provide a perpetual source of revenue for your Parish, School, favorite Ministry or Program of the Diocese or Missionary Projects of the Diocese. The principal of your gift remains on deposit and continues to grow, while every year the Catholic organization you’ve chosen receives income from your gift forever. An endowment may be opened with a contribution of cash, securities or other property, and may be added to at any time by you or someone else wishes to contribute the same organization.

You, as a donor, may choose to establish a restricted or unrestricted endowment fund, or both. You may assign your gift to your own Parish for its use in any manner you designate or to any other Catholic organization that you wish. You may also request that your donation simply be used to provide the greatest good to the greatest number as an unrestricted gift.

Reverend Norman Poupore Endowment – Support of Priests’

Disabilities

Catholic Charities Endowment – Corporate purposes

Society of the Sisters of St. Joseph Endowment – Corporate purposes

Society of the Propagation of the Faith Endowment – Corporate

purposes

St. Joseph’s Home Foundation Endowment – Corporate purposes

Catherine Aurelia Endowment – Bishop’s Charities and Religious

Works

Reverend Anthony A. Milia Endowment – Support of the Diocesan

Archives

Building For Tomorrow Endowment – Operating expenses of the

Catholic Community of Alexandria

Education of Seminarians Endowment – Funding to the annual

operating budget

Faylene LeRoux Endowment – Support of Catholic Education

Formation For Ministry Endowment – Parish financial assistance and

annual operating budget

Guggenheim/Hughes Endowment – Support of capital needs of

Guggenheim Center

Leona Schlafly Endowment – General purposes of the Diocese of

Ogdensburg

Reverend James Meehan Endowment – Special care of priests

St. Mary’s Cathedral Endowment – Support of general operations

Joseph & Joyce Sylvester Endowment – General operating needs of

St. Anthony’s, Watertown

Guggenheim Maintenance Endowment – Maintain the main camp building,

boathouse and grounds

Spratt Memorial Endowment – Support capital needs

St. Alexander’s Catholic Education Endowment – Support of Catholic

education at parish

Alice Austin Trust Mass Endowment – Masses at St. Andrew’s Church,

Sackets Harbor

Lawrence R. Robinson Trust Mass Endowment – Masses at St. Andrew’s

Church, Sackets Harbor

St. Augustine’s Church Endowment – General purposes of St.

Augustine’s at Peru.

Margaret Brothers Endowment – General purposes of St. Patrick’s

Church, Rouses Point

Victor West Endowment – General purposes of St. Patrick’s Church,

Rouses Point

St. Mary’s Champlain NY Endowment – Support of St. Mary’s Church

Reverend W. Cyril Rapin Endowment – Support of disabled priests

Good Samaritan Endowment – Christian charity to the people of the North

Country

Holy Family Strauss Educational Endowment – Promote Catholic

education

Deacon Adam Crowe Scholarship Endowment – Education of Seminarians

William Cornish Endowment – St. Henry’s Church, EWTN, Diocese

Donald J. GrantEndowment –

General purposes of RC Community of Brownville & Dexter

St. Lawrence ChurchEndowment – General purposes of St. Patrick’s Church in Brasher Falls

St. Patrick’s Church ShamrockEndowment – General purposes of St. Patrick’s Church in Brasher Falls

Queen of Heaven Church – General purposes of Queen of Heaven Church

Church of St. Patrick/Stumpf Family – Catholic Education

ME Walton Good SamaritanEndowment – Needs of parishioners at St. Cyril’s and St. Francis Xavier

Special Care of PriestsEndowment – Funding for annual operating budget

Alice Austin Mass Endowment – Masses at Queen of Heaven Church,

Henderson

St. Francis of Assisi Endowment – 50% Diocese, 50% Covenant House

William L. PatnodeEndowment – Education of Seminarians

Gertrude J. Tyo Endowment – Education of Seminarians

Chapin, McCarthy, LaBelle Families Endowment – General purposes St.

Augustine (North Bangor)

Chapin, McCarthy Families Endowment – General purposes St. Martin

de Porras, Peru (Missionary Projects)

St. Patrick's & Mother Cabrini's Shrine of Peru, NY Endowment

– General purpose of Shrine

Thomas and Ann Fiacco

Endowment – General purposes Trinity Catholic School, Massena, NY

Thomas and Ann Fiacco

Endowment – General purposes Trinity Catholic School, Massena, NY

Bishop Brzana Chapter

Vocations – emergency medical/dental assistance to active Seminarians

Brian E. McManus

& Alison E. McManus Endowed Scholarship Fund in Memory of Dorothy W.

McManus – Tuition assistance for students of financial need at St. Agnes

Catholic School

Halsey J. Seguin

Memorial Scholarship Fund - to benefit poor students of St. Bernard’s

Catholic School as they see fit

Education of Seminarians/St. Joseph’s HomeEndowment – Education of Seminarians & St. Joseph’s Nursing Home Foundation

general purposes

Leonard J. Furnia Endowment Fund – Support of

Education of Priests & Seminarians

Saint Ignatius Special Needs Endowment Fund – special

need grants for extra ordinary, emergency, one-time situations

Francis & Constance Kehoe Memorial Endowment Fund – Education of Seminarians and Graduate

Studies for Clergy of the Diocese of Ogdensburg

The Leary Family Endowment Fund – General purposes

Trinity Catholic School, Massena NY, and St. Peter’s Parish, Massena NY

The Lamb Trust Fund (St. Agnes School) - Annual scholarship or scholarships for St. Agnes Catholic School students or such other purposes as the school to determine.

Dear Sisters and Brothers in Christ:

Over the past 35 years since being ordained to the Priesthood back

in 1988 and the Holy Father selecting me to be your Bishop in 2010, I have witnessed

and been inspired by the tremendous commitment of the faith-filled people in

the Diocese of Ogdensburg to stay united and continue Christ’s mission of

helping our fellow brothers and sisters in the Church of the North Country.

From one generation to the next, the faithful of the Diocese

of Ogdensburg have generously supported one another as we continue to build up

the Body of Christ here in the North Country.

With much trust and firm faith, our local parishes are growing in

vibrancy and vitality. Now more than

ever, in these challenging times, we need to look ahead to ensure that the

mission of the Church continues to be Christ-led, Christ-fed, and Hope-filled.

We are called to: protect the vulnerable, promote human dignity, celebrate the

Sacraments, defend the poor, seek justice, and participate in worship with our

parish family.

In 2007, in

order to “Build a Bridge for the Future” and continue a strong sense of commitment, the Foundation of the Roman

Catholic Diocese of Ogdensburg was established with the purpose of preparing

the Diocese to meet these needs of tomorrow. Since that time, 55 permanently

restricted Endowments have been established.

These endowment

gifts are a perpetual source of revenue for the Diocese, Parishes, Schools,

Ministries, Nursing Home, and Missionary Projects of the Diocese. I am

extremely appreciative and grateful to those who have contributed to the

Foundation and have invested in our Catholic community’s future.

As I present

you this 2022-23 Annual Report, please take a moment to review the Endowments

as well as our mission statement, what a Catholic Foundation truly is and how

it works along with methods of giving.

The Foundation

is an instrument for you to make a legacy for the next generation and for generations

to come. If you have not already done so, I encourage you to consider

developing an estate plan for the benefit of your loved ones and those close to

your heart.

I would like to

express my gratitude to the Board of Directors for their willingness to serve,

provide guidance, ensure legal ethical integrity and for their wise stewardship

in overseeing the investments and dividends of its funds.

Wishing God’s

blessing to you and your loved ones, I am

Faithfully yours in Christ,

Most Reverend Terry R. LaValley

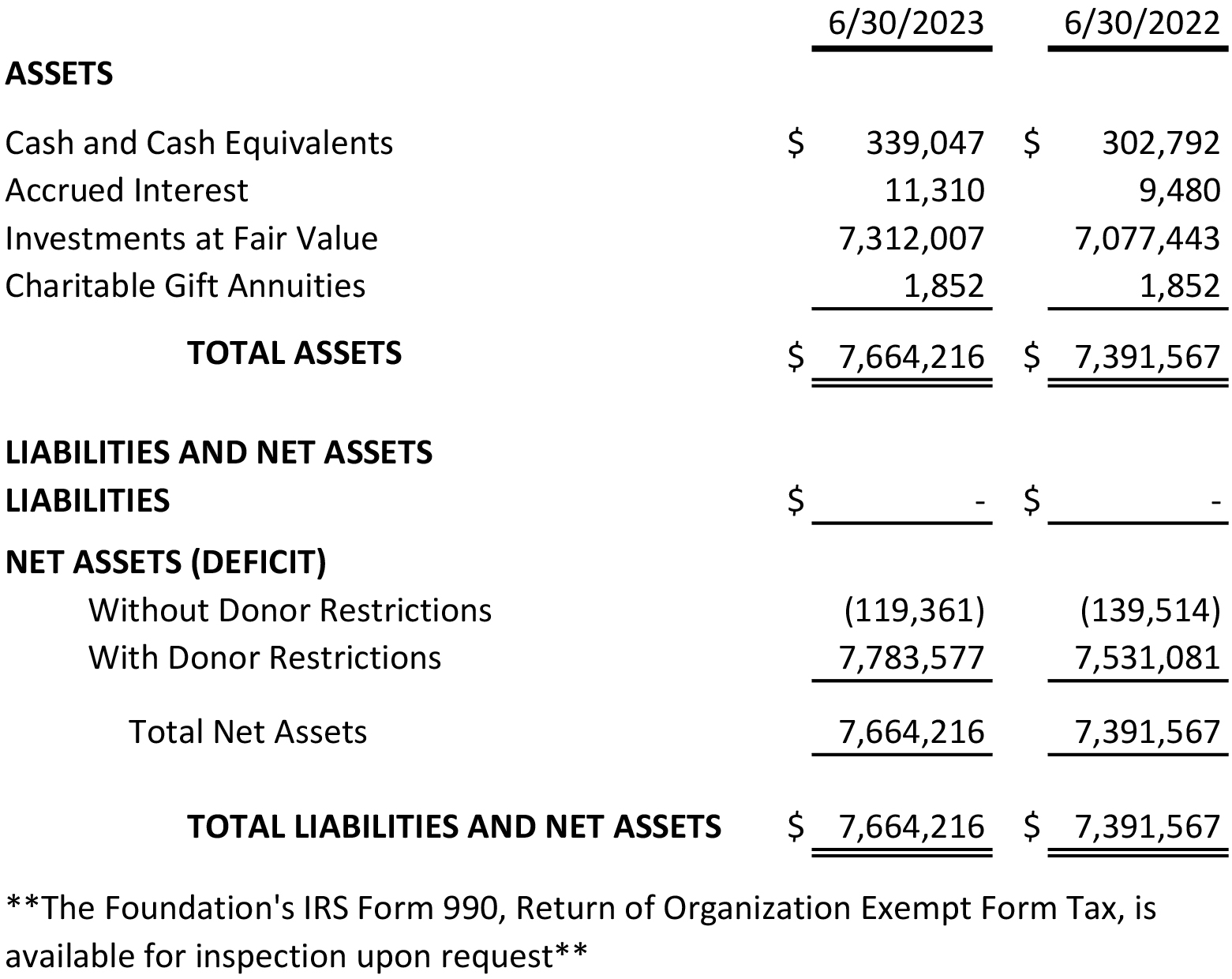

The Foundation solicits, invests and stewards endowed funds

and planned gifts to benefit the people and communities of the Diocese as

designated by the donors. Prudent financial management of the funds is

entrusted to the Board of Trustees comprised of distinguished church, business

and civic leaders. A professional staff administers the day-to-day operations

of the Foundation and oversees the distribution of earnings from the funds.

Assets are managed by investment professionals.

New endowments can be started with a minimum gift of $5,000 through

a variety of methods of giving as the donor

selects the beneficiary and establishes the

name of the Endowment (often a tribute or memorial). Contributions can also be

made to existing endowments. Endowment gifts

keep the principal intact and distribute quarterly dividends to the

beneficiary.

The benefit of this type of gift is it provided a perpetual

gift to something the donor has strong beliefs and ties to during and after

his or her lifetime.

Outright Gift

Bequest

Charitable Gift Annuities

Insurance Policies

Charitable Remainder Trust

Charitable Lead Trusts

Retirement Plan/IRA

Scott Lalone

Executive Director

315-393-2920